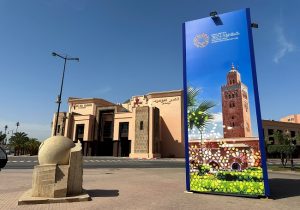

As the Moroccan city of Marrakech prepares to host the annual meetings of the World Bank and the International Monetary Fund (IMF) from October 9 to 15, 2023, observers have been discussing items that will be tabled for discussion at the global gathering.

A common and all too familiar theme across all the diplomacy summits of the past few months was the need for the reform of the international financial system, including putting effective mechanisms in place to triple low-cost financing for developing countries and ensuring debt relief for debt distressed countries.

Over the past few months more support has come out strongly for the various proposals on overhauling the global financial architecture:

- The G20 shareholders have backed ajoint agreement calling for “better, bigger and more effective” multilateral development banks.

- The biggest client countries, including from the African continent, have calledfor concrete, time-bound action on the proposals to reform the multilateral financial system to make it fair and equitable and help the continent build resilience to climate shocks.

- The G77+ China – a bloc of 134 developing and emerging countries representing 80% of the world’s population – stressedthe urgent need for a comprehensive reform of the international financial architecture and a more inclusive and coordinated approach to global financial governance.

- The public development banks have laid out their commitments to contribute to the reform process.

- The UN Secretary General has urgedthe financial institutions to urgently act on reforms. and the youth and people’s movements have taken to the streets to demand reforms to the international financial institutions which possess a key role in shaping multilateral finance globally.

The key issues that are likely to be discussed in October

Unlocking new concessional financing

New research indicates that implementing the recommendations of the Capital Adequacy Framework review could help unlock nearly $190 billion in additional low-cost financing for developing countries without jeopardising the Bank’s high preferred AAA credit rating.

The recent statement from the World Bank’s president, Ajay Banga,suggests that new contributions from wealthy countries combined with balance sheet changes could boost the bank’s lending capacity by $100 billion to $125 billion over a decade. However, Banga himself has acknowledged that this would be woefully inadequate as compared to the current needs and “is a pimple on a dimple on an ant’s left cheek compared to what we need in the world.”

Earlier, it was reported that the US would consider a $25bn capital increase for the Bank and could stretch this figure to more than $100 billion if other G20 nations made similar pledges.

The World Bank’s evolution roadmap and updated mission

The World Bank’s development committee had taken stock of the World Bank Group’s updated evolution roadmap back in April.They agreed to make progress on balance sheet optimisation for IDA, develop options for enhanced callable capital and shareholder-purchased hybrid capital, and explore a potential voluntary channelling of Special Drawing Rights (SDRs). The Board has agreed to an updated mission of the Bank on “eradicating poverty and promoting growth on a liveable planet”.

However, the formal approval from the World Bank governors is still awaited. We could see an updated evolution roadmap and the updated mission statement from the Bank during the upcoming World Bank and IMF meetings.

New mechanisms to reduce the cost of hedging the billions of dollars of inwards investment

Mia Mottley and her advisor, Avinash Persaud, are calling for new mechanisms such as a partial foreign exchange (FX) guarantee to reduce the cost of capital to drive in private capital at scale. This proposal could gather further momentum in Marrakech during the World Bank and IMF annual meetings.

A new allocation of Special Drawing Rights and recycling through AfDB

African leaders have called on the IMF to consider allocating a new sum of $650 billion of Special Drawing Rights for climate crisis response, distributed more equitably as compared to the last allocation. They are also backing a proposal to rechannel the Special Drawing Rights through the African Development Bank, which could hold them as hybrid capital. Progress on these key demands could be seen at meetings.

US proposal for the loss and damage facility as a Financial Intermediary Fund under the World Bank

The US has proposed that the Loss and Damage Facility should be hosted by the World Bank, effectively taking this facility out of the UNFCCC space. This would mean that the World Bank provides secretariat services and serves as a trustee for the fund.

This proposal has sparked concerns, given the lack of an independent board for the proposed facility and the idea that this would give extra representation to major donors on top of the existing developed country representation, which would “tilt the power towards wealthy countries.”