Socio-Economic Rights and Accountability Project (SERAP) has urged President Bola Tinubu to “urgently direct Mr. Lateef Fagbemi, the Attorney General of the Federation and Minister of Justice, to widely publish a certified true copy of the version of the tax bills received from the National Assembly and a certified true copy of the tax laws signed by you.”

The documents requested by SERAP are: the National Revenue Service (Establishment) Act; the Joint Revenue Board of Nigeria (Establishment) Act; the Nigeria Tax Administration Act; and the Nigeria Tax Act.

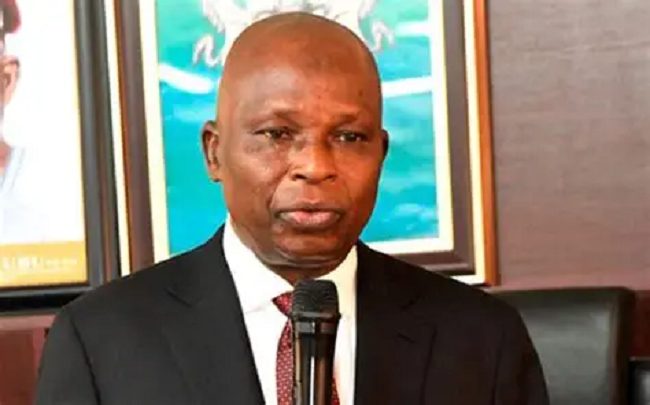

SERAP urged him “to direct Mr Lateef Fagbemi to clarify whether the version of the tax bills received from the National Assembly are exactly the same contents as the bills that were signed into laws by you and the version ultimately gazetted.”

SERAP also urged him to “urgently establish an independent panel of inquiry to promptly, independently, impartially, transparently and effectively investigate the allegations that there are material differences between the tax bills passed by the National Assembly and the tax laws ultimately gazetted by the Federal Government.”

In the Freedom of Information request dated December 20, 2025, and signed by SERAP deputy director, Kolawole Oluwadare, the organisation said: “The panel should have the mandate to establish the facts of what exactly occurred and identify those suspected to be responsible for the alleged alterations.”

SERAP said, “The proposed panel should be headed by a retired Justice of the Supreme Court of Nigeria or Court of Appeal. The findings of the panel should be made public. Anyone responsible for the alleged alterations must face prosecution, as appropriate.”

According to SERAP, “Widely publishing a certified true copy of the version of the tax bills received from the National Assembly and a certified true copy of the tax laws signed by you would allow Nigerians to scrutinise the laws and compare them with the version of the tax laws ultimately gazetted.”

SERAP said, “The alleged unlawful alterations of the tax laws would offend the provisions of the Nigerian Constitution 1999 (as amended) the requirements of international human rights law, and the fundamental principles of the rule of law and separation of powers.”

The letter reads in part: “The law-making processes including the passing of any bills and signing them into laws, as well as gazetting the laws must meet the requirements of the Nigerian Constitution, the rule of law and separation of powers.

“This means that any passed bills and signed laws must be accessible, authentic, intelligible, clear, legitimate, and predictable so that people can know and comply with them.

“Clarifying whether the version of the tax bills received from the National Assembly are exactly the same contents as the bills that were signed into laws by the President and tax laws ultimately gazetted would promote transparency and accountability and help to address any threats to Nigerians’ human rights.

“We would be grateful if the recommended measures are taken within 7 days of the receipt and/or publication of this letter. If we have not heard from you by then, SERAP shall take all appropriate legal actions to compel your government and the Attorney General to comply with our request in the public interest.

“Widely publishing the certified true copies of the tax bills passed by the National Assembly and the tax laws signed by the President and the gazetted versions would also allow Nigerians to identify if the provisions of the laws are consistent with their human rights and seek effective remedies to challenge any infractions of the rights.

“Your government has the obligations under the Nigerian Constitution and the human rights treaties to which the country is a state party to promptly, independently, impartially, transparently and effectively investigate the alleged unlawful allegations of the tax laws and to ensure full accountability in this case.

“Our requests are brought in the public interest, and in keeping with the requirements of the Nigerian Constitution, the Freedom of Information Act, and the International Covenant on Civil and Political Rights and the African Charter on Human and Peoples’ Rights to Nigeria is a state party.

“According to our information, the National Assembly recently alleged that there are unlawful alterations and some material differences between the tax bills passed by the legislative body and the tax laws gazetted by the Federal Government.

“A Sokoto lawmaker, Abdussamad Dasuki, raised the issue under a matter of privilege, drawing the attention of the House to the alleged discrepancies between the harmonised versions of the tax bills passed by both chambers of the National Assembly and the copies gazetted by the Federal Government.

“The National Assembly said the alterations contained in the gazetted copies did not receive legislative approval. These alleged unlawful alterations raise questions over the legality and legitimacy of both the law-making processes and the versions of the tax laws currently being circulated by the Federal Ministry of Information.

“The National Assembly established that substantive provisions were inserted, deleted, or modified after passage by both chambers. Several oversight, accountability, and reporting mechanisms approved by parliament were reportedly removed in the final Acts. New coercive and fiscal powers (e.g., arrest powers, garnish without court order, compulsory USD computation, appeal security deposits) were also reportedly inserted in the final Acts without legislative approval.

“Section 39 of the Nigerian Constitution, article 9 of the African Charter on Human and Peoples’ Rights and article 19 of the International Covenant on Civil and Political Rights guarantee the right to seek, receive and impart information.

“The Nigerian Constitution, the African Charter on Human and Peoples’ Rights and the International Covenant on Civil and Political Rights impose duties on your government to ensure transparency and accountability in lawmaking processes.

“By the combined reading of the provisions of the Nigerian Constitution, the Freedom of Information Act, the International Covenant on Civil and Political Rights, and the African Charter on Human and Peoples’ Rights, there are transparency obligations imposed on your government to widely publish the certified true copies of the version of the tax bills received from the National Assembly and the tax laws signed by you.

“The Nigerian Constitution, Freedom of Information Act, and the human rights treaties rest on the principle that citizens should have access to information regarding their government’s activities.”