The Civil Society Legislative Advocacy Centre (CISLAC) has urged the Federal Government to leverage the nation’s tax system to accelerate the transition from fossil fuels to renewable energy.

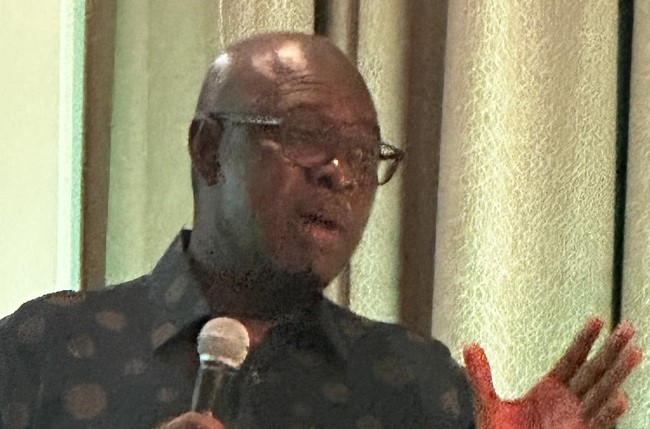

Speaking at a workshop on “Fossil Fuel Transition Using the Instrumentality of Taxation” in Benin on Thursday, May 8, 2025, Comrade Auwal Musa, CISLAC’s Executive Director, warned that Nigeria risked missing its NetZero2050 target without bold fiscal reforms.

The workshop, supported by Tax Justice Network Africa and hosted in partnership with Connected Advocacy, brought together civil society leaders, climate advocates and some media representatives in Edo State.

Musa, popularly known as Rafsanjani, challenged government agencies to implement Nigeria’s Energy Transition Plan with urgency and transparency.

“Are we moving swiftly enough to meet our climate goals? Are our policies and actions aligned with the global climate agenda,” he asked.

Musa asserted that Nigeria must phase out fossil fuel subsidies and use taxation to incentivise clean energy while protecting the livelihoods of those affected by the transition.

“Nigeria’s fossil fuel dependence has not only degraded the environment but deepened poverty in oil-producing communities.

“Tax justice is a powerful tool to correct this imbalance and create a greener economy,” he said.

Musa, queried the government on the status of the energy transition plan, the mechanisms for stakeholder engagement, and strategies for ensuring a just transition that protect workers and vulnerable communities.

“The energy transition must not repeat the mistakes of the past. Communities must be part of the conversation, and policies must be inclusive,” he said.

In his goodwill message, Mr. Israel Orekha, Executive Director, Connected Advocacy, said the workshop aimed to empower civil society to engage more effectively with government policy on climate and energy.

“Edo State, being oil-producing, stands at the heart of this national debate.

“We need to ensure our communities benefit from the shift to clean energy and not suffer because of it,” he said.

Orekha said Nigeria had a fantastic policy framework for combating climate change, but was poor in implementation.

He called for more awareness creation on climate change and its impact among the locals.

In his lecture, Mr. Chinedu Bassey, an expert in taxation, called for increased taxes on gasoline, diesel, and other petroleum products to discourage fossil fuel consumption in the country.

He described taxation as a good mechanism for energy transition, while redirecting the funds towards clean energy initiatives.

He advocated taxes on inefficient energy-consuming appliances and technologies in Nigeria.

The discussion focused on how Nigeria can use progressive taxation to disincentivise fossil fuel exploration and redirect resources into clean energy investments.

The event concluded with a call for sustained advocacy and deeper collaboration between civil society, government, and the private sector to deliver a just and equitable energy future for Nigeria.

By Usman Aliyu