The Corporate Accountability and Public Participation Africa (CAPPA) has called on the Federal Government of Nigeria to immediately increase the excise tax on tobacco products to 100 percent to save thousands of lives, and at least ₦526 billion annually from healthcare costs and productivity losses.

In a statement issued on Thursday, August 7, 2025, CAPPA warned that the tobacco industry is continuing to aggressively target Nigerians with traditional and novel smokeless tobacco products like vapes and other e-cigarettes, despite tobacco use being a major risk factor for costly, debilitating diseases.

The World Health Organisation (WHO) links tobacco use to premature death from lung cancer, chronic obstructive pulmonary disease, dementia, sudden infant death syndrome (SIDS), birth defects, vision loss, gastrointestinal diseases, skin damage, weak bones and cardiovascular disease, among other NCDs.

Citing data from the Nigerian Tobacco Control Data Initiative, the statement noted that 90 percent of tobacco production happens in developing countries like Nigeria, which mostly bear the environmental costs of tobacco production, while rich countries make most of the profits from tobacco production.

According to the federal government, Nigerians consumed over 20 billion sticks of cigarettes annually as of 2018, while almost 30,000 people die each year in the country from tobacco-related diseases.

Relying on an analysis by the Centre for the Study of the Economies of Africa (CSEA), CAPPA said Nigeria spent ₦526.4 billion treating tobacco-related diseases in 2019.

The statement noted that, currently, Nigeria employs a mixed excise tax system on tobacco products, comprising an ad valorem tax of 30 percent on the unit-cost-of-production or manufacture price, a specific excise tax of ₦84 per pack (20 cigarettes) which became effective on June 1, 2022, and a shisha/tobacco tax of ₦3,000 per litre or ₦1,000 per kg, rising ₦500 annually. Although the federal government proposed increasing the tax to 50 percent in April 2023, this increase has not yet been implemented, and the current regime remains unchanged.

CAPPA urged Nigeria to align with global best practices and also emulate African countries like Senegal, Kenya and South Africa that are taking tough measures against tobacco use to protect their youths from addiction, disease and financial ruin.

Last Friday, Senegalese Prime Minister, Ousmane Sonko, increased taxes on tobacco to 100 per cent from 70 per cent.

Two days earlier, Kenya’s government announced an immediate ban on the importation of tobacco and nicotine-containing products such as vapes, citing an alarming increase in youth addiction rates. It pointed to the need to stem cheap, widely available imported products that undermine local regulations and facilitate underage consumption.

On June 3, South Africa proposed new measures to tighten tobacco control and outlaw vaping and smoking in public. The country’s Health Department made the proposal after seeing evidence that vapes not only contain nicotine, which is highly addictive, but that the vapour from vaping is harmful to the lungs.

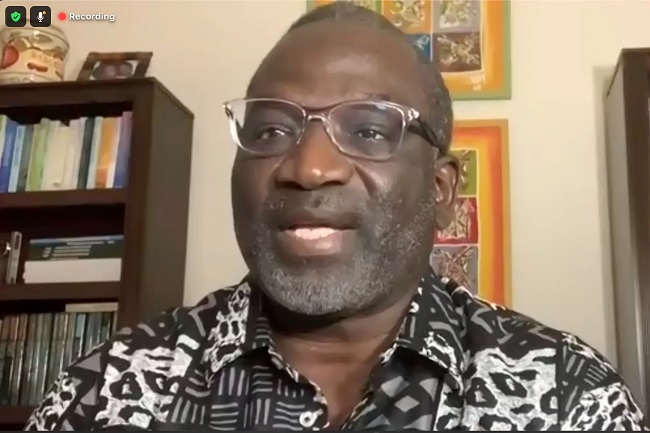

“In Nigeria, the tobacco industry is having a field day aggressively targeting young Nigerians with their novel products such as vapes and other e-cigarettes, which they know are not only addictive, but also harmful. Using their so-called ‘tobacco harm reduction strategy’, the tobacco industry continues to hoodwink the public that vapes, and other e-cigarettes, are harmful to human health, but good for consumption,” said Akinbode Oluwafemi, Executive Director at CAPPA.

He warned that tobacco-related diseases strain Nigeria’s health systems, drain health budgets, reduce workforce productivity, and exacerbate poverty.

Oluwafemi added: “What the tobacco industry is doing is grooming the next set of addicts to replace the thousands of Nigerians who die from tobacco-related diseases and the many others whose lives are destroyed. They must be stopped.

“We urge the government to act fast and raise the taxes on tobacco and related products to 100 percent. This is a proven way to not only discourage tobacco and e-cigarette use, but also save billions in healthcare costs.”

Furthermore, CAPPA urged the federal government to ring-fence part of the revenue for health promotion, non-communicable diseases (NCDs) prevention, and full implementation of the National Tobacco Control Act.

Finally, it advised governments at all levels to resist tobacco industry interference, which continues to undermine life-saving policies for profit.